maine property tax calculator

You can enter amounts into the text fields or drag the sliders to the correct amount. The amounts shown are based on percentages derived from the approved FY19 Town of Hampden budget.

Maine Property Tax Calculator Smartasset

Maine has a number of tax credits that benefit taxpayers in certain situations.

. Generally property taxes are higher in the more southern and urban counties in Maine. Please note this is only for estimation purposes -- the exact cost will be determined by the city when you register your vehicle. The car sales tax in Maine is 550 of the purchase price of the vehicle.

The Property Tax Division is divided into two units. The median income in Maine is 56277. It is important to note that closing costs can vary widely depending on the mortgage and lender you choose.

If there is something missing that you think should be added to this page feel free to email us with the link or suggestion. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Ad Look Up Any Address in Maine for a Records Report.

The calculator below will help give you an idea of what it will cost to renew the current registration on your passenger vehicle. Property taxes are 351 of income in Maine 17th highest in the country. See Results in Minutes.

This state sales tax also applies if you purchase the vehicle out of state. In those areas the state transfer tax rate would be 300. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Maine local counties cities and special taxation districts.

This calculator is for the renewal registrations of passenger vehicles only. The median property tax in Maine is 193600 per year for a home worth the median value of 17750000. Maine has a 55 statewide sales tax rate and does not allow local governments to collect sales taxes.

The interactive calculator below allows property tax payers to enter the amount of their annual bill to learn how those dollars are allocated to various Town expenses. As many of you probably already know the mil rate is only one of the equations in determining how much youd pay in property taxes. Showing 1 to 498 of 498 entries.

Maine Income Tax Calculator 2021. The countys average effective property tax rate of 100 is the lowest in the state and well below the state average of 130. This means that the applicable sales tax rate is the same no matter where you are in Maine.

This calculator is excellent for making general property tax comparisons between different states and counties but you may want to use our Maine property tax records tool to get more accurate estimates for an individual property. A single filer in Maine who earns 57000 per annual will take home 4461515 after taxes. To use our Maine Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Overview of Maine Taxes Maine has a progressive income tax system that features rates that range from 580 to. The State of Delaware transfer tax rate is 250. Its pretty fascinating to see the growth rate over the past several years.

Municipal Services and the Unorganized Territory. The median income in Maine is 56277. The median property tax payment in the county is just 1433.

Your average tax rate is 1198 and. The average rate in Maine is 109 18th in the country. Some areas do not have a county or local transfer tax rate.

This page provides information of interest to municipal assessors and other property tax officials in Maine. How does Maine rank. Our division is responsible for the determination of the annual equalized full value state valuation for the 484 incorporated municipalities as well as for the unorganized territory.

Married filers no dependent with a combined annual income of. Maine residents seeking low property tax rates might want to consider Hancock County. Counties in Maine collect an average of 109 of a propertys assesed fair market value as property tax per year.

Most counties also charge a county transfer tax rate of 150 for a combined transfer tax rate of 400. Delaware DE Transfer Tax. This income tax calculator can help estimate your average income tax rate and your salary after tax.

Maine Property Tax Calculator. Estimate your monthly payments what you might need for a down payment and mortgage insurance at closing using the calculator below. The second variable is how much your property is assessed at.

Each spending category below corresponds to a Town budget category. In many cases we can compute a more personalized property tax estimate based on your propertys actual assessment valuations. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs.

The first number after the decimal point is tenths 1 the second number after the decimal point is hundredths 01 and going out three places is thousandths 001 or mills. Maine is ranked number twenty out of the fifty states in order of the average amount of property taxes collected. After a few seconds you will be provided with a full breakdown of the tax you are paying.

If you make 70000 a year living in the region of Maine USA you will be taxed 12188. Searching Up-To-Date Property Records By State Just Got Easier. The state valuation is a basis for the allocation of money.

The state income tax rate in Maine is progressive and ranges from 58 to 715 while federal income tax rates range from 10 to 37 depending on your income. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact your county or citys property.

For example if you purchase a new vehicle in Maine for 40000 then you will. For comparison the median home value in Maine is 17750000. In short if the vehicle is registered in the state of Maine then the Maine car sales tax of 550 will be applied.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Did You Know In 2021 Property Tax Tax Reduction Tax Services

Property Taxes By State 2017 Eye On Housing

Orange County Ca Property Tax Calculator Smartasset

Ask Hannah Holmes What Is The Best Natural Way To Battle Weeds In 2021 Colonial Renovation Insulation Closed Cell Foam

What S Being Done To Reduce High Property Taxes In Illinois Property Tax Estate Tax Illinois

623 Main Street Commercial Property Real Estate Tours

Utah Income Tax Calculator Smartasset Income Tax Income Tax Return Federal Income Tax

Maine Property Tax Rates By Town The Master List

The Cook County Property Tax System Cook County Assessor S Office

Property Taxes By State 2017 Eye On Housing

2013 New Hampshire Tax Rates For Lakes Region Town Sorted By Town And By Rate New Hampshire Town Names Winnipesaukee

Orange City S Total Property Tax Levy Rate Ranks 551st In The State Orange City

How To Calculate Property Tax And How To Estimate Property Taxes

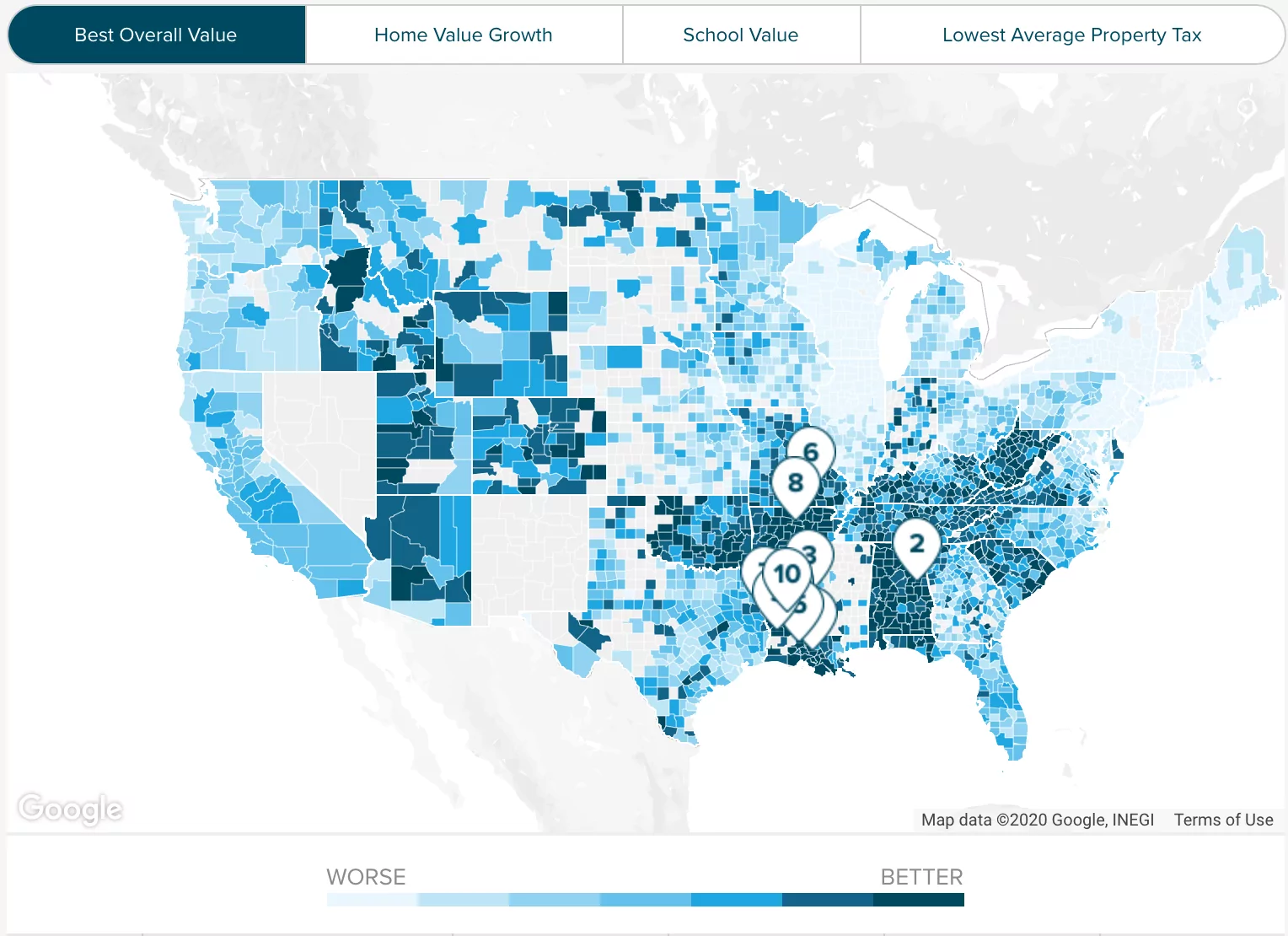

Property Tax By State Ranking The Lowest To Highest

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

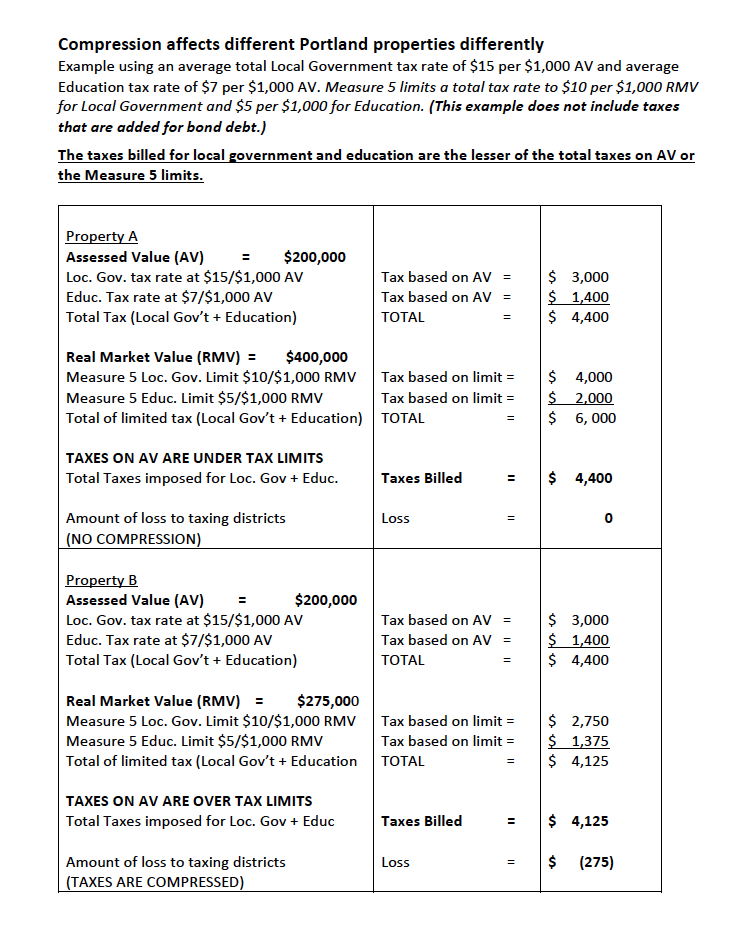

Property Taxes Compression Ballot Measures League Of Women Voters Of Portland

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax States Small Towns Usa